News and insight

International Workplace and DPD highly Commended at SHE Awards

We are delighted to announce that International Workplace and DPD have been Highly Commended for the Safer Logistics Award at the SHE Awards.

International Workplace and DPD shortlisted for SHE Awards

International Workplace is delighted to announce it has been shortlisted alongside DPD for the prestigious SHE Awards, in the category of the Safer Logistics Award.

2023 Young FM Manager Award open to entries

Applications are open for the 2023 Young FM Manager Award, supported by the Worshipful Company of Pattenmakers. In recent years the Company has become the Livery home of the facilities management industry and of professionals from across the built environment sector, in addition to its traditional membership from City institutions and the footwear industry.

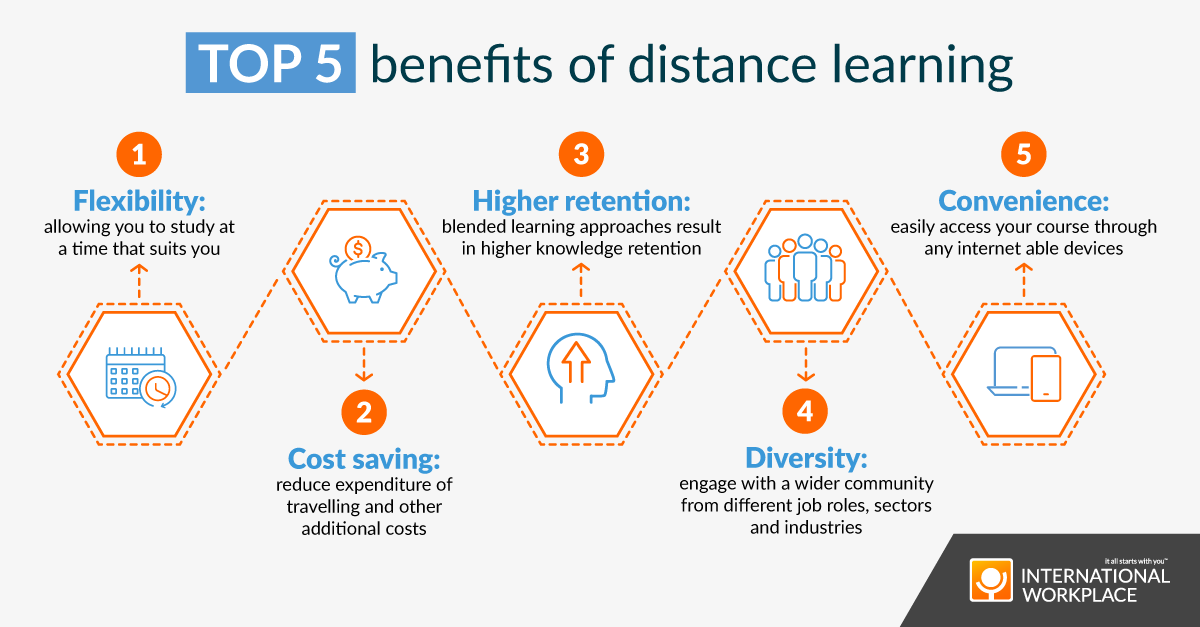

Happy World Distance Learning Day!

Wednesday 31 August marks World Distance Learning Day, which embraces learning that takes place outside of a physical classroom, be that remote learning delivered entirely at a distance, or a hybrid blend of classroom and home learning.

David Sharp

AI in safety, health and wellbeing – the ethics, challenges and pitfalls

The impact of AI is often described in terms of extremes. On the one hand, it’s seen as a technological breakthrough to allow us to transcend the physical limits of our human bodies, which could let us live forever. On the other hand, the moment AI becomes intelligent enough to surpass us, it could be the end of humans and humanity altogether.

Clare Makowski

Psychological safety – trusting people to trust you as a business

Psychological safety – the belief that one can speak up without risk of punishment or humiliation – is long established as a crucial component to high-quality decision making, healthy group dynamics and interpersonal relationships. Whilst simple to understand when explained like that, so many of us are unclear on how to really ensure its presence in our organisations and what we are all responsible for in making it happen.

Kate Gardner - my health and safety journey

“What to you want to do when you leave school?” Become a nurse, was always my reply. “Oh, you’ll be good at that” was the automatic response from everyone, so why do I find myself writing this after spending most of my working career in health, safety and facilities management?

Jamie Robinson - my health and safety journey

I joined International Workplace during the COVID-19 pandemic and my role as health and safety trainer includes the delivery of IOSH Managing safety and NEBOSH General Certificate courses within commerce and industry.

Jane Patching – my health and safety journey

My health and safety journey began in 2014 when I was recruited from a quality auditing position into a health and safety role and subsequently studied for my NEBOSH General Certificate. This was an exciting challenge and I strongly believe my auditing background gave me a good platform to start from.

FM and sustainability: the social, environmental and commercial challenge

Sustainability is a huge topic – broad in scope, critical in importance, and replete with both opportunity and risk. In commercial terms, sustainability aims to achieve the balance between economic, environmental and social impacts through the effective management of resources while maximising organisational profitability.